Another Bureaucratic Backflip for Japanese Crypto?

Just when Japanese crypto traders thought they might finally catch a break, another delay looms. Tomoya Asakura, the blunt CEO of SBI Global Asset Management, just dropped a bombshell on X: crypto tax reform might not kick in until 2028. That’s right, 2028. For those doing the math, that’s another four years of getting hammered by a tax system designed to bleed them dry.

Japanese media outlet CoinPost, citing an unnamed political insider, reported a potential one-year delay to these much-hyped tax plans. While “not yet finalized,” the mere whisper of it sent shivers down spines. Asakura’s reaction? “This is an extremely slow schedule.” He didn’t mince words, declaring that Japan would fall behind not only the U.S. but also Asia and the Middle East in Web3 development. Given SBI is a financial heavyweight, a major Ripple partner, and runs its own SBI VC Exchange, his frustration isn’t just hot air—it’s a direct hit on Japan’s future.

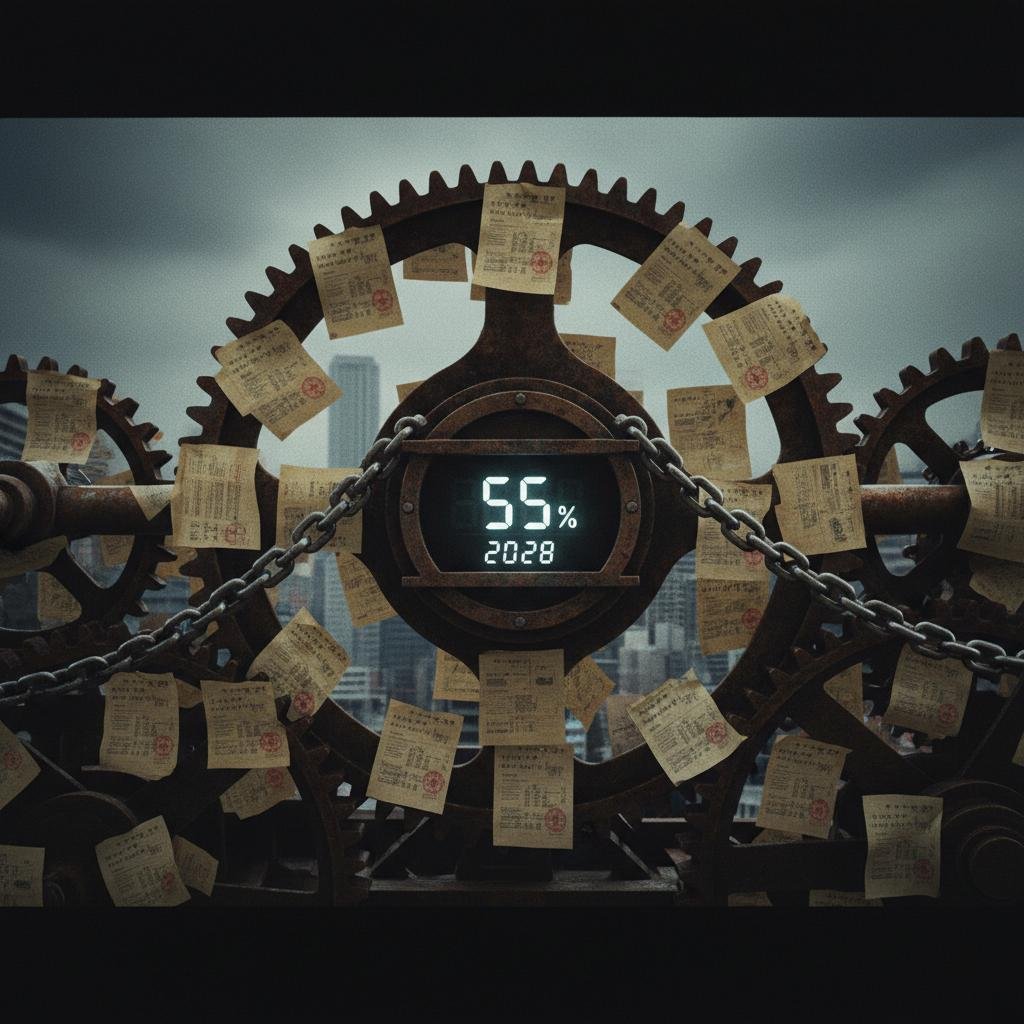

The Crushing Burden: 55% and No Netting

To understand the depth of this frustration, you need to grasp Japan’s current crypto tax regime. It’s a punitive system, plain and simple. Right now, if you make a profit trading crypto in Japan, it’s classified as miscellaneous income. This means you’re staring down the barrel of an income tax rate that can climb as high as 55%.

Let that sink in. Fifty-five percent. For context, stock and forex traders enjoy a flat 20% capital gains tax. But the disparity doesn’t end there. Crypto traders can’t offset their losses against their profits. Nor can they carry forward those losses to future tax years. Imagine navigating a volatile market like crypto, taking heavy losses one year, only to be taxed on any meager gains the next, with no way to balance the books. It’s a system that actively discourages participation, stifles innovation, and often feels like a cruel joke to anyone trying to build wealth in this space.

The “why” behind this is rooted in Japan’s cautious approach to new asset classes. While they were early adopters, the regulatory framework struggled to keep pace, often treating crypto more like a speculative gambling chip than a legitimate investment vehicle.

The Promised Land That Keeps Moving

Lawmakers and regulators aren’t entirely oblivious to the problem. Even the Financial Services Agency (FSA) has acknowledged the need for change, signaling a desire to level the playing field. Their solution? Reclassify cryptocurrencies as proper investment vehicles. This move would be a game-changer, bringing crypto in line with traditional assets and, crucially, subjecting gains to a flat 20% capital gains tax.

But it’s not just about the tax rate. The proposed reforms also promised a much-needed simplification of tax returns. Imagine exchanges introducing tax-compliant systems that automate the headache-inducing process of tracking every single crypto trade for your annual declaration. For an ecosystem already grappling with complexity, these seemingly small procedural changes would be a massive relief, freeing up traders and companies to focus on what matters: building and investing.

The original timeline had the Japanese National Diet, the country’s parliament, approving an amendment in early 2026. This would bring crypto under the umbrella of the Financial Instruments and Exchange Act. With a typical year for legal revisions to become law in Japan, traders had optimistically marked January 2027 on their calendars. Now, that date is in serious jeopardy, pushed back by an unknown force of bureaucratic inertia.

Stifling Innovation and Global Ambition

As Asakura starkly puts it, these delays aren’t just about individual traders’ wallets. They’re about Japan’s place in the global Web3 race. While countries like the UAE and parts of Europe are actively courting crypto and blockchain innovation with progressive regulatory frameworks and attractive tax incentives, Japan risks falling further behind. Consider SBI’s own plans to launch a yen-denominated stablecoin in the first half of 2026—a move that directly relies on a clear, favorable regulatory environment. Such delays throw a wrench into strategic business decisions and capital allocation.

The “how” of this stifling effect is straightforward:

- Talent Drain: High taxes and regulatory uncertainty push skilled developers, entrepreneurs, and investors to more welcoming shores.

- Lack of Institutional Adoption: Major financial institutions and corporations, even those bullish on Web3, remain hesitant when the tax landscape is so volatile and unfavorable.

- Stifled Innovation: Startups are less likely to emerge or thrive in an environment where the economic viability of their product is undermined by punitive taxation.

- Reduced Market Liquidity: With fewer incentives for domestic trading, capital may flow to offshore exchanges, reducing the vibrancy and depth of Japan’s own crypto markets.

Japan was once a pioneer in the crypto space, but these consistent regulatory hiccups threaten to relegate it to an also-ran. The world isn’t waiting. Other nations are actively competing to become global Web3 hubs, offering clear rules, lower taxes, and proactive support. Each delay in Japan is a missed opportunity, a signal to the world that innovation here comes with a heavy asterisk.

The Cynic’s Conclusion

For Japanese crypto traders and Web3 enthusiasts, this news is a familiar, bitter pill. The promise of a fair, competitive tax environment dangles tantalizingly close, only to be pulled away at the last minute by the glacial pace of bureaucracy. While regulators acknowledge the issue, the political will and speed needed to enact meaningful change seem perpetually out of reach.

So, what’s the takeaway? Don’t hold your breath. Japan’s crypto scene looks set for more frustrating years under a tax system that’s a relic of the past, while the rest of the world speeds ahead. The “extremely slow schedule” isn’t just a lament; it’s a stark warning of Japan’s diminishing relevance in the rapidly evolving world of digital finance.