Another Day, Another Scam: Filmmaker Carl Rinsch Gambles Netflix Cash on Dogecoin

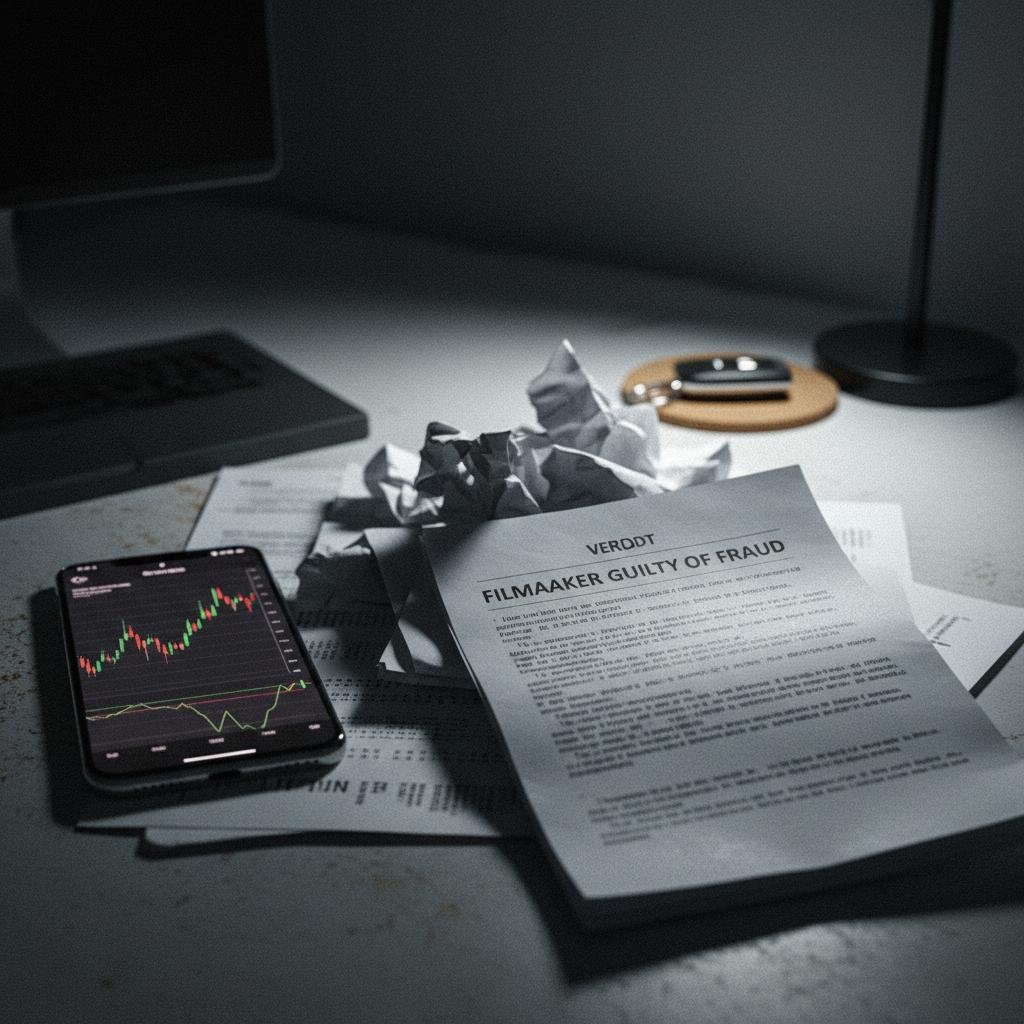

In news that probably surprised absolutely no one watching the crypto markets for the past few years, a Hollywood filmmaker just got slapped with a guilty verdict. Carl Erik Rinsch, the genius behind 2013’s 47 Ronin (remember that one? Exactly.), was found guilty on Thursday of swindling Netflix out of a cool $11 million. His alleged crime? Blowing the streaming giant’s cash on “extremely risky” securities and, of course, a hefty dose of crypto speculation. Some of that crypto? None other than Dogecoin, the internet’s favorite meme coin.

The whole saga is less a dramatic thriller and more a cautionary tale wrapped in a clown show, proving that even big-budget Hollywood players aren’t immune to the siren song of quick riches and outright fraud. Rinsch now faces sentencing in April 2026 for wire fraud, money laundering, and five counts of engaging in monetary transactions with unlawfully acquired property. That’s a long time to reflect on those Dogecoin gains.

From Sci-Fi Dreams to Speculative Screams

Here’s how the story unfolded: Netflix, ever keen on original content, initially shelled out a whopping $44 million to Rinsch to produce a grand sci-fi series called “White Horse.” Sounds promising, right? But in 2020, Rinsch, then 48, managed to convince them to fork over another $11 million. The stated purpose? To keep the “awesome and moving forward really well” production rolling. The reality? A direct transfer to a personal brokerage account and a rapid descent into high-stakes gambling.

Court documents paint a clear picture: Rinsch didn’t just mismanage the funds; he actively diverted them. Instead of funding elaborate sets or special effects, the money vanished into speculative stocks. After losing a significant chunk there, he pivoted to crypto. This wasn’t a strategic pivot, mind you. This was desperation meeting the 2021 bull market, a last-dditch attempt to recoup losses in an environment where even a dog-themed joke coin could print life-changing wealth.

Dogecoin, Rolls-Royces, and Really Fancy Bed Sheets

While the US Department of Justice kept mum on the specific cryptocurrencies Rinsch favored, the New York Times, having peeked at his account statements, dropped the bombshell: Dogecoin. Yep, the digital asset famously championed by Elon Musk saw some of Netflix’s unproduced show budget flow into its volatile ecosystem. Rinsch evidently hit a lucky streak in 2021, making some gains during the peak of meme coin mania. What did he do with his newfound “wealth” (derived from fraud, let’s not forget)?

He didn’t reinvest it into “White Horse.” He didn’t return it to Netflix. Instead, he embarked on a lavish spending spree that reads like a parody of excess:

- Lawyers for his divorce (because, naturally, financial fraud doesn’t make for a stable marriage).

- Luxury goods, including “fancy bedsheets and clothes” (because comfort is key when you’re facing federal charges).

- Five Rolls-Royce cars (one for each day of the work week, perhaps?).

- A Ferrari (because five Rolls-Royces just aren’t enough to outrun your problems).

Meanwhile, “White Horse” remained firmly unproduced, a ghost in Netflix’s content library, and the $11 million? Gone. United States Attorney Jay Clayton didn’t mince words: “Carl Erik Rinsch took $11 million meant for a TV show and gambled it on speculative stock options and crypto transactions.” A damning indictment, indeed.

Why This Netflix Saga Matters to Crypto

For crypto traders and Web3 enthusiasts, this story isn’t just about a greedy filmmaker; it’s another ding on the industry’s already tarnished reputation. Here’s why it resonates:

First, it reinforces the mainstream narrative that crypto is a playground for fraudsters and a haven for ill-gotten gains. Every headline like this, where a significant sum of scammed money ends up in digital assets, feeds into the perception of crypto as inherently risky and often associated with illicit activity. It’s a headache for legitimate projects and honest investors trying to navigate the regulatory minefield.

Second, it highlights the seductive, yet dangerous, allure of meme coins and rapid market movements. Rinsch, seemingly desperate, poured money into Dogecoin during its meteoric rise. While he saw some gains, the core of his behavior was speculative gambling with stolen funds. This serves as a stark reminder of the extreme volatility and “get rich quick” mentality that, while sometimes delivering, can also lead to catastrophic losses – or, in Rinsch’s case, federal charges.

Third, it’s a lesson in due diligence, or rather, the lack thereof. How did Netflix, a multi-billion dollar corporation, allow an additional $11 million to vanish into a director’s personal trading account without proper oversight? This speaks to broader issues of financial controls and accountability, especially when dealing with large sums and high-risk investments. For anyone investing in projects or allocating capital, Rinsch’s tale is a loud alarm bell: vet your partners, track your funds, and don’t take anyone’s word for it when millions are on the line.

Finally, this conviction, while not directly a crypto enforcement action, showcases the relentless pursuit of financial fraud by authorities like the US Department of Justice. It doesn’t matter if the stolen funds briefly touched a crypto exchange; if a crime was committed, the legal system will follow the money trail. This reinforces the evolving regulatory landscape, where illicit activities, regardless of the asset class, will face severe repercussions.

The Long Road to Accountability

Netflix, as of now, remains silent on the matter, likely trying to distance itself from this embarrassing episode. Rinsch, meanwhile, has ample time until April 2026 to ponder his choices behind bars. The “White Horse” remains unfinished, a monument to greed and a cautionary tale. For the crypto world, it’s another splash of cold water, reminding everyone that while digital assets offer innovation, they also attract the same old human vices: speculation, fraud, and a desperate grab for unearned wealth.