The XRP Supply Shock Myth: Math vs. Moonboy Logic

If you have spent more than five minutes on crypto Twitter lately, you have probably seen the chart. It is a sleek, downward-sloping Glassnode graph that supposedly proves XRP is vanishing from exchanges. The narrative is simple, seductive, and—if you ask the people actually running the network—completely wrong. The “supply shock” sirens are blaring, but before you FOMO into a position based on a perceived shortage, we need to talk about the massive delta between influencer hopium and on-chain reality.

The latest firestorm started when accounts like @unknowDLT began circulating claims that XRP liquid supply is being “drained” by newly minted ETFs. The argument suggests that with only 1.5 billion XRP left on exchanges and 750 million absorbed in just weeks, we are headed for a catastrophic (or glorious, depending on your bag) supply squeeze by early 2026. It is a classic narrative pivot: moving XRP from a speculative asset to “global liquidity infrastructure” via the legislative nudge of the “Clarity Act.”

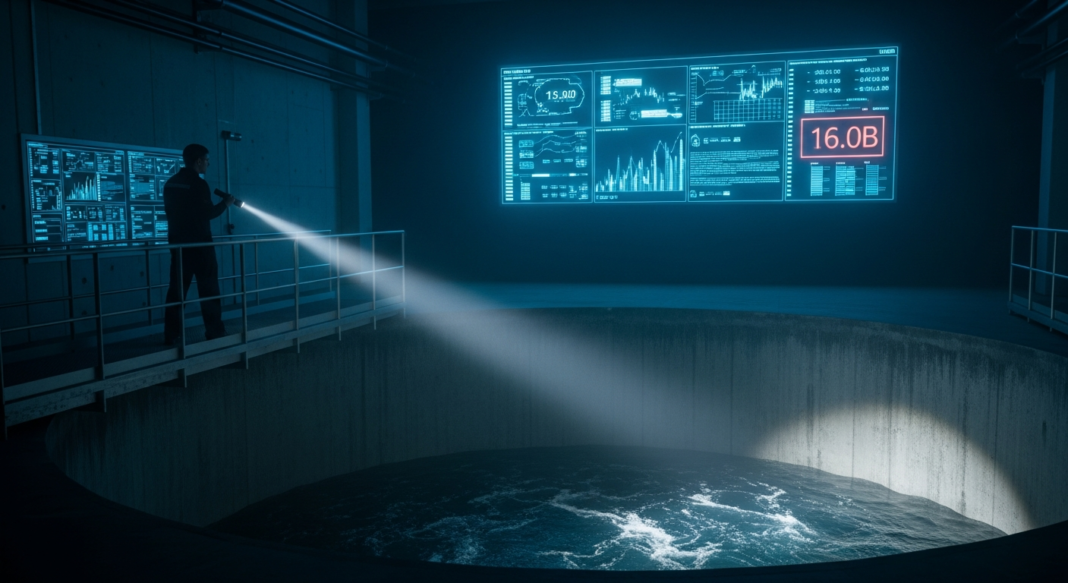

But Vet, an XRP Ledger (XRPL) dUNL validator, isn’t buying it. In the world of crypto, validators are the ones keeping the lights on; they see the plumbing that influencers ignore. Vet countered the scarcity claims with a much grimmer number for the bulls: 16 billion. That is the amount of XRP he estimates is sitting on exchanges, ready to be dumped the moment the price hits a target. We aren’t looking at a drought; we’re looking at a reservoir.

The 14.5 Billion XRP Discrepancy

Why is there a 14.5 billion XRP gap between what influencers say and what validators see? It comes down to the dark art of wallet labeling. Services like Glassnode and CryptoQuant rely on identified exchange clusters. If an exchange moves funds to a new, unlabeled cold wallet, the “exchange balance” chart drops. To a casual observer, it looks like supply is leaving the market. To a veteran, it just looks like an exchange doing its quarterly security hygiene.

Vet pointed out that popular pundits are likely looking at a “lower bound” of exchange holdings. He cited Upbit, the South Korean giant, which holds over 2 billion XRP in just four of its many accounts. When you factor in the massive liquidity pools on Binance, Bybit, and OKX, the idea that the entire world is fighting over 1.5 billion tokens becomes laughable. This mirrors the “Bitcoin is leaving exchanges” narrative we saw in late 2020. While it can signal bullish sentiment, it rarely translates into an immediate mechanical “shock” because of how dynamic liquidity actually is.

The Myth of Static Liquidity

The fundamental mistake the “supply shock” crowd makes is treating exchange order books like a grocery store shelf. In a grocery store, if there are ten cartons of milk and I buy ten, the shelf is empty. Crypto does not work that way. Markets are elastic. Vet describes this as “dynamic” liquidity. If the price of XRP jumps 20%, billions of tokens sitting in private Ledger Nano S wallets or Xumm accounts can—and will—hit an exchange in roughly 3.5 seconds.

I have seen this movie before. In 2017, the narrative was that Ripple’s escrow would “lock up” supply and force the price to the moon. In reality, the market absorbed the escrow releases, and the massive “diamond hand” retail crowd provided all the exit liquidity the whales needed. Order books thicken and dry out in seconds. A $10 million buy order might spike the price at 3:00 AM on a Sunday, but that same $10 million might not even move the needle during the New York open when institutional desks are active.

ETFs, Escrows, and the Institutional Pivot

The pro-shock camp, including voices like Dman Trader, argues that even if the 16 billion figure is correct, the “effective float” is tightening. They point to the fact that XRP ETFs are sequestering tokens into dedicated wallets. They claim 1% of the total supply has been locked up in just a few months. While it is true that Ripple facilitates supply transfers for these ETFs, we have to look at the other side of the ledger: the Ripple Escrow.

For those who weren’t around for the 2017-2018 cycle, Ripple holds the majority of the total XRP supply in a series of escrows. Every month, 1 billion XRP is released. Usually, Ripple sells a portion to ODL (On-Demand Liquidity) customers and re-locks the rest. This creates a perpetual supply ceiling that Bitcoin simply doesn’t have. Unless the demand from ETFs and cross-border settlement significantly outpaces the monthly “un-lock” and the 16 billion XRP already sitting on exchanges, a “shock” is mathematically improbable.

The “Clarity Act” mentioned by influencers is another piece of the puzzle. The hope is that regulatory certainty will force banks to use XRP as a bridge currency. We have heard this since the xRapid days of 2018. While the legal victory against the SEC provided a massive boost to XRP’s legitimacy, institutional adoption is a marathon, not a sprint. Banks don’t buy billions of dollars of volatile assets on the open market; they use OTC (Over-The-Counter) desks specifically to *avoid* causing a supply shock that would hurt their own entry price.

Risk Assessment: Narrative vs. Reality

So, where does that leave the average trader? You have to separate the *sentiment* from the *mechanics*. The sentiment is undeniably bullish. The launch of XRP ETFs and the end of the SEC’s dark cloud are genuine catalysts. However, betting on a “supply shock” that renders the token scarce is a dangerous game.

- The Escrow Overhang: Ripple still holds a massive treasury. Any significant price spike gives them an incentive to fund operations or expand the ecosystem by selling into the strength.

- The “Ghost” Liquidity: Don’t trust exchange balance charts blindly. They are conservative estimates. The actual amount of XRP ready to be sold is almost certainly higher than what Glassnode shows.

- Regulatory Lag: Even with the “Clarity Act,” the wheels of global finance turn slowly. Don’t expect “global liquidity infrastructure” to happen by a specific date in 2026 just because a chart says so.

In short: XRP isn’t running out. It is just moving around. If you are buying because you believe in the long-term utility of the XRPL, that’s one thing. If you are buying because you think the “shelves are empty,” you might find yourself providing the liquidity for the very people who convinced you to buy.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Crypto markets are highly volatile; always do your own research.